BY E.B. BOYD

Facebook makes money by placing ads next to your status updates and photos. How hard could their business be? As its S-1 filing reflects, that answer is more challenging than you think.

Facebook's money-making model has always been pretty simple: It creates a place for people to hang out and upload photos or pithy notes on what they are doing right that second, and then it posts advertising along the side of that status update highway. How complicated could it be?

Well, a little, it turns out. The social network filed an S-1 on Wednesday in advance of its IPO that presents a more complex and nuanced picture of the company's business--one that highlights the tradeoffs Facebook has to make in order to create value for both users and advertisers, as well as of the creative challenges that lay ahead.

Facebook is going to have to balance a number of competing interests. It's going to have to figure out how to get people to share more of their lives on the social network, while figuring out how to display only the most interesting stuff to each individual person, and simultaneously developing ever more innovative ad products that Facebookers deem useful and relevant rather than intrusive.

More Facebook Coverage

Be sure to read about the Facebook investors poised to make billions from the social network's impending IPO. And take a deep dive into our earlier profile of Mark Zuckerberg: Hacker. Dropout. CEO. Then compare the Zuck of yesterday with the Zuck who just penned a letter to investors. Plus, dig into all of the revenues and user numbers. Check back here for more to come in the days ahead.

It's not a simple proposition. Which is partly why, as the S-1 reports, that the company has tacked up signs on the walls of its new Menlo Park campus that say "this journey is 1% finished."

The basics of Facebook's business remain the same: Social networkers create content (in the form of updates, photos, links, Likes, and Comments), and Facebook sells ads targeted to either the person or the content. Advertising brings in the bulk of the social network's revenue. Of the $3.7 billion the company made last year, $3.2 billion came from ads.

Payments from third-party apps that sit on top of Facebook (like Zynga's mega-hit FarmVille) only brought in $557 million, and the majority of that came from… Zynga.

For Facebook to merit its projected $100 billion valuation (or even $85 billion), it's going to have to ratchet up that ad revenue. Which it can do by bringing in more people to show ads to, serving more ads on every page, or raising the price of ads.

No matter what path it takes--and it will most likely choose all of the above--it doesn't have the option of going Geocities-crazy on its audience. Zuckerberg has always been fiercely committed to the product itself, and his letter to investors that accompanied the S-1 said he would always put users' interests first.

Growing the absolute number of people visiting the network isn't a viable long-term strategy. Facebook already has 845 million members, and, with seven billion people on the planet, and China effectively off limits, you can only double the user base so many times before you run out of people with computers and Internet access.

So instead, Facebook is going to focus on increasing the amount--and amount of time--that people spend using the network, thus delivering more ads at higher rates, with a better value for advertisers. To accomplish all that, Facebook's got to make the service more valuable for everyday Like-ers, and increase the amount of media they're willing to share; the more Facebook knows about you, the better it can target an advertiser's message to your timeline.

The IPO filing says that the average amount of content created and feedback shared--via Likes and comments--"has continued to increase over time." It doesn't say by how much, though it does say that, by the end of last year, Facebookers were adding 2.7 billion Likes and Comments to the network each day.

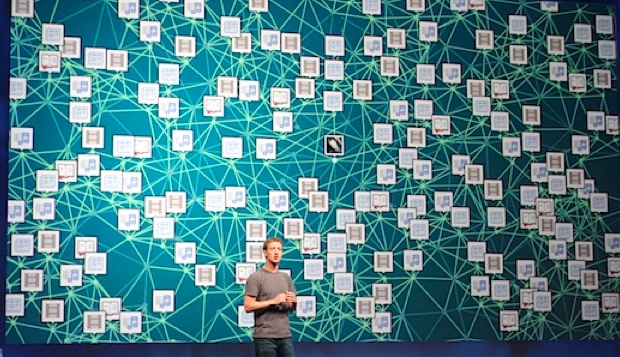

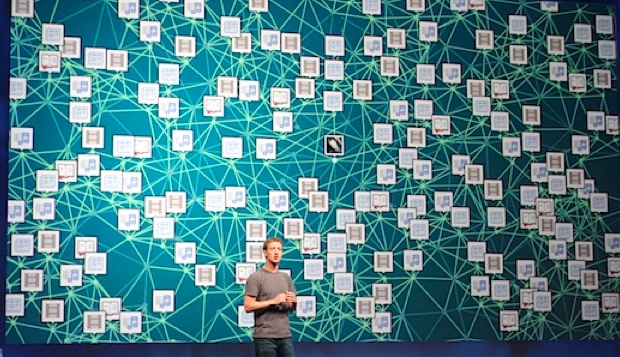

Facebook intends to turbo charge that activity through its new Open Graph and the "social applications" that third parties, like RunKeeper, Foodily, and Ticketmaster are creating. These apps allow more information about people's interests to flow into Facebook.

At the same time, Facebook has a huge algorithmic challenge. It wants to ensure that the information users see in their News Feeds is as interesting as possible, given that, according to its IPO filing, it's competing with outside entities like Twitter, Google+, and traditional and online media, for what little attention everyone has left. Which means Facebook has a massive search-and-retrieve exercise on its hands that it has to carry out on a person-by-person basis in real time.

Facebook has long said that it doesn't serve up each piece of content that your friends create to you--only the things it thinks you will find most interesting. "We use a proprietary distributed system that is able to query thousands of pieces of content that may be of interest to an individual user to determine the most relevant and timely stories and deliver them to the user in milliseconds," the IPO filing says.

With exponentially more updates flowing into the system from the integrated social apps, Facebook is going to have to sort through more data faster. It's a technical challenge along the lines of the Google search algorithm. While Google seeks to find the most relevant search results from all the documents out on the web, Facebook has to figure out what among all the data in its system is most relevant to each of its 845 million individual users.

Meanwhile, Facebook is going to have increase advertising without alienating everyone. It already knows it does a good job of helping advertisers with targeting. "Because authentic identity is core to the user experience on Facebook and users generally share information that reflects their real interests and demographics," the S-1 says, "we are able to deliver ads that reach the intended audience with higher accuracy rates compared to online industry averages." A campaign aimed at adults between the ages of 25 and 49, for example, had a 95% accuracy, compared to the industry average of 72%.

But where it will have to continue to innovate is in developing ad units that Facebookers appreciate (like Sponsored Stories)--and react to. The more people appreciate the ads, the less risk of alienating them and reducing usage of the system. And the more people react to the ads, the more valuable they become to advertisers.

"Our advertising strategy centers on the belief that ad products that are social, relevant, and well-integrated with other content on Facebook can enhance the user experience while providing an attractive return for advertisers," the S-1 says. "We intend to invest in additional products for our advertisers and marketers… while continuing to balance our monetization objectives with our commitment to optimizing the user experience."

Now, how hard could that be?

[Images: Flicker user dtweney]

No comments:

Post a Comment